Callahan’s Guide To The 2023 Final Four

The sports analysts at Callahan & Associates wrap up March Madness with predictions based on credit union performance data. Which team will reign supreme?

The sports analysts at Callahan & Associates wrap up March Madness with predictions based on credit union performance data. Which team will reign supreme?

As spring planning sessions get underway, these are the questions credit union leaders need to be asking to ensure maximum impact.

More consumers are entering the mainstream banking system, but more than a quarter of loan applicants say they aren’t getting the funds they need.

Look beyond the headlines to discover the driving forces behind market trends and consider how they impact a credit union’s investment portfolio.

The crisis is still unfolding, but the latest high-profile bank failure has plenty of takeaways for credit unions around asset management, net worth, communication, and more.

Line of credit usage increased just as the Federal Reserve began to hike interest rates, increasing the cost of borrowing for credit unions across the country.

Fall business planning sessions are operational in nature. Spring strategy sessions are all about relevance and impact.

Loan balances were up 20% year-over-year, surpassing the previous industry record.

DEI, financial wellbeing, and economic uncertainty were the big topics of the day.

The battle for fee income, the crucial role of impact, and more were all highlights of the first day’s sessions in Washington.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

When money stops making sense, people suffer a crisis of financial confidence. Now’s the time to reconnect with members to help them establish long-term stability.

From the teller line to the corner office, CEO Cheryl Sio’s story spans five decades of industry transformation and enduring leadership lessons.

Structured protection strategies provide potentially higher long-term total returns than bonds while muting the volatility and downside risk traditionally associated with equities.

The CEO of Peninsula Community Federal Credit Union highlights how active listening and lessons from the basket court shape a culture of inclusive banking that serves members and employees.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

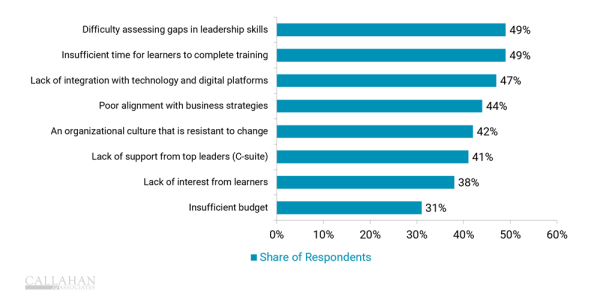

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

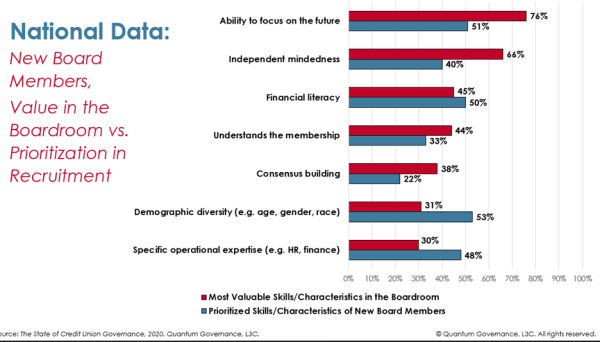

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.