When peer credit unions merge, combining their brands is more than a design challenge — it’s a strategic opportunity to build trust, unify cultures, and position the new organization for long-term success. Brand integration during this crucial time is one of the most complex — and consequential — tasks credit union marketers face. From aligning messaging to managing member expectations, the process demands careful planning and collaboration.

Brand integration isn’t something to tackle alone. Luckily, credit union marketers have myriad ways to make great connections within the industry and learn from the experiences of others. From conferences to professional groups, league support, and even Callahan Executive Roundtables, an extensive network is a valuable resource for leaders.

Here, three credit union marketing leaders provide experience-based tips for approaching the challenge.

1. Find Commonalities

“Look for what both organizations have in common,” says Kendrick Walker, vice president of marketing and business development for MyUSA Credit Union ($343.5M, Lebanon, OH).

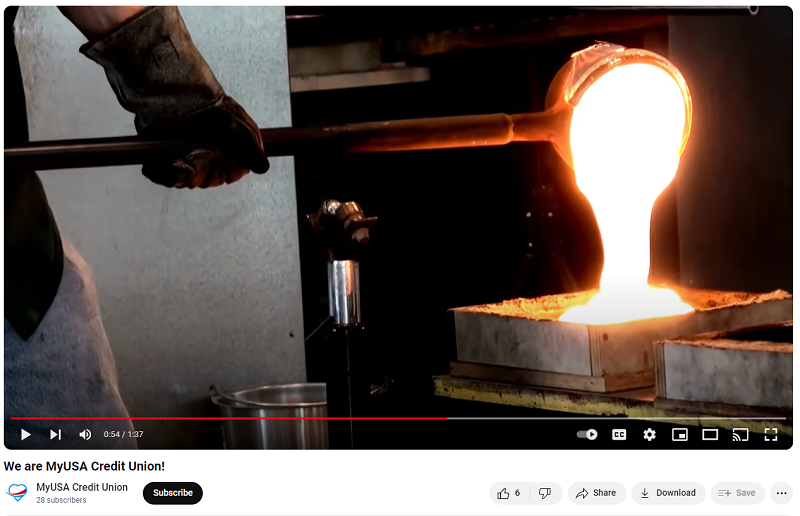

His own credit union, MyUSA, was born from the merger of MidUSA Credit Union and Heartland Federal Credit Union in the summer of 2021. The merger combined state-chartered and federally chartered entities that were founded to serve steelworkers on the one hand and the communications industry on the other.

“Even though our organizations served different core memberships, we were able to lean in to how everyone in the communities we serve comes together,” Walker says.

That shared sense of place became the foundation for MyUSA’s brand identity as the credit union focused on the local creeks and waterways its Greater Miami Valley communities enjoy.

“We all enjoy getting outside, hiking on the miles of local trails or taking canoes or kayaks on the water,” Walker says. “It supersedes everything else and binds us together. We all love calling Southwestern Ohio home.”

2. Read From The Same Page

When Hiway Federal Credit Union and SPIRE Credit Union merged in early 2024 and rebranded as Blaze Credit Union ($4.5B, Falcon Heights, MN), leaders of the combined entity worked together to overcome the hurdles of merging two strong brands and similarly sized institutions.

“Since this was a merger of equals, we knew we had to change the name to create a new cooperative with a new vision,” says Lisa Lehman, vice president of marketing and business development for Blaze. “Once everybody got around that idea, the actions we needed to take became much clearer, and it was easier to start having conversations.”

The internal team began by brainstorming about who Blaze wanted to be, what its history was, how it defined values, what its future would look like, and what messages it wanted to put into the market.

“During the initial stages, it was just a few senior leaders involved in the discussion,” Lehman says. “We also interviewed several people from each organization to better understand their thoughts and what their credit union was all about.

As that process continued, the marketing teams from both organizations along with an outside agency and a couple of executives led the charge to rebrand. The team completed most of this work behind-the-scenes as SPIRE and Hiway didn’t know for certain whether members and regulators would approve the merger, but they had to have things ready to go.

Like MyUSA, before becoming Blaze, SPIRE and Hiway served two very different fields of membership. Fortunately, Blaze had a common thread to build upon.

“We had a pick-up truck mascot named Archie after our founder Edgar Archer,” Lehman says. “That pick-up truck tied in nicely to the road that was so prevalent in Hiway’s brand, so we started going down that path and discussing the road of life and blazing trails.”

3. Tell A Compelling Story

Following the merger of Charlotte Metro and Premier FCU, the internal team knew the combined organization needed a brand that would embrace all its communities while symbolizing its mission to teach, guide, direct, and educate consumers so they may live a richer, more meaningful, and expansive lifestyle.

That’s the story behind Skyla Credit Union ($1.6B Charlotte, NC).

“The new Skyla brand embodies our vision — building financial freedom for all — by providing the support and personalized banking experience to help our members plan, implement, and achieve their goals,” says Rachel Garnham, vice president of marketing for Skyla Credit Union. “Our positioning strategy is the story of possibility: Skyla is your friendly, neighborhood credit union — here to make things possible! We’re in your community, meeting you wherever you are in your financial journey, and helping put your goals within reach.”

4. Pay Homage To History

Although the focus of any rebranding is typically on the future, taking the time to understand and pay homage to the past is also important.

“As we rolled out our new brand, we acknowledged our roots in the steel and communications industries,” Walker says.

That recognition of the new cooperative’s dual legacy was present in everything from MyUSA’s press releases to its website and brand introduction video.

“We still have a branch where we lean into those roots, using more blue-collar imagery, as it’s located in what was AK Steel, now Cleveland-Cliffs,” he says.

For Blaze, getting the right people in the room — including leadership, board, and marketing representatives from both credit unions — helped ensure the new brand reflected the legacies of SPIRE and Hiway.

“Rebranding after a merger requires marrying the past with where you want to go in the future,” Lehman says. “Your brand should help tell your story. How your credit union is different from other financial institutions and how you use that difference to benefit your marketplace are what make you stand out.”

5. Communicate Clearly. Communicate Often.

All three credit unions tout the importance of external and internal communications, relying on physical letters, emails, social posts, PR announcements, and mass media like TV, billboards, and digital advertising. Plus, branch signage.

“We focused on getting our name out into the market and clearly tying it back to SPIRE and Hiway,” says Lehman at Blaze. “All of our messaging the first three to four months focused on that key message: Hiway and SPIRE are now Blaze.”

According to Lehman, the credit union opened a record number of new checking accounts in the first six months after the rebrand Blaze.

For Skyla, its biggest surprise was how long the trademarking process took. However, that also provided the credit union the time it needed to roll out its new name and brand all at once.

“We kept our member communication timeline short,” Garnham says. “Throughout the merger, members were aware that we were working toward a new name for the unified organization. Once ready, we ripped off the band-aid quickly and flipped member-facing assets at the same time.”

6. Address Concerns … But Stay Positive

Change, even positive change, is stressful. MyUSA found involving staff as well as its leadership team in the rebranding process was helpful.

“We did a high-level survey of staff to see what they understood about a brand in general, how the organizations were viewed in the past, and what they’d like to see in the future,” Walker says.

From there, the leadership team explored various brand attributes and even conducted its own brand camp to ensure everyone was on the same page and set goals for what they wanted to accomplish together. Overall, the entire process took approximately two months — a tight timeframe for developing an entirely new brand.

According to Lehman at Blaze, employees and members alike both had strong affiliations with the SPIRE and Hiway names going into their merger.

“We tried to be positive about the change,” she says. “Our approach has been to consistently focus on the benefits and how this helps us compete in the market.”

7. Celebrate The New Brand

When it comes to new-brand employee buy-in, celebration is the name of the game. Daily touchpoints can include surveys, focus groups, online and in-person meetings, scavenger hunts, new swag, and more; a big event that reveals the new brand and creates excitement is another effective way to make a splash.

Blaze hosted a launch party for its new name in November 2023. More than 600 associates attended the event, which included dinner and a program that addressed the new name, what it meant, brand colors, and more.

“The official name change happened Jan. 1, 2024, so the timing was great,” Lehman says. “It helped us build excitement and prepare our team to talk about the new brand.”

Choosing a new brand is a deeply personal decision that carries the weight of legacy, identity, and future vision. The name must reflect the organization’s mission while honoring its roots and inspiring its future. And once the credit union has its name, it must craft a story that members can connect with and rally behind.

“It’s not any different from naming a child on some level,” Lehman says. “A marketer’s job is to tell the story. You can’t sell a secret, which is why we are so focused on clearly explaining what our name means and how it ties back to our mission and vision.”