With mortgage refinance volumes virtually nonexistent, many lenders are focusing their attention toward the purchase mortgage market. That includes finding new ways to attract younger, first-time homebuyers. Despite higher interest rates, higher prices and lower inventory, many in the 25-34 age group still want to make their dreams of homeownership happen.

The average first-time homebuyer in the United States today is approximately 35 years old, a figure that has gradually increased since the late 1980s and then jumped in the early 2020s. The average credit union member is 52 years old — a decade older than it was 20 years ago.

Credit unions need young members and young borrowers. Getting one is a challenge, getting both is even tougher.

But that’s not to say it can’t be done.

At Liberty Federal Credit Union ($3.8B, Evansville, IN) and Veridian Credit Union ($7.5B, Waterloo, IA), borrowers between the ages of 25 and 34 made up roughly one quarter of all mortgages originated last year — approximately 1,000 and 1,500 loans each for that age bracket, respectively.

Start By Serving Day-To-Day Banking Needs

Jeff White, senior vice president of mortgage lending for Liberty FCU attributes his credit union’s success to having the right people, products, and delivery channels.

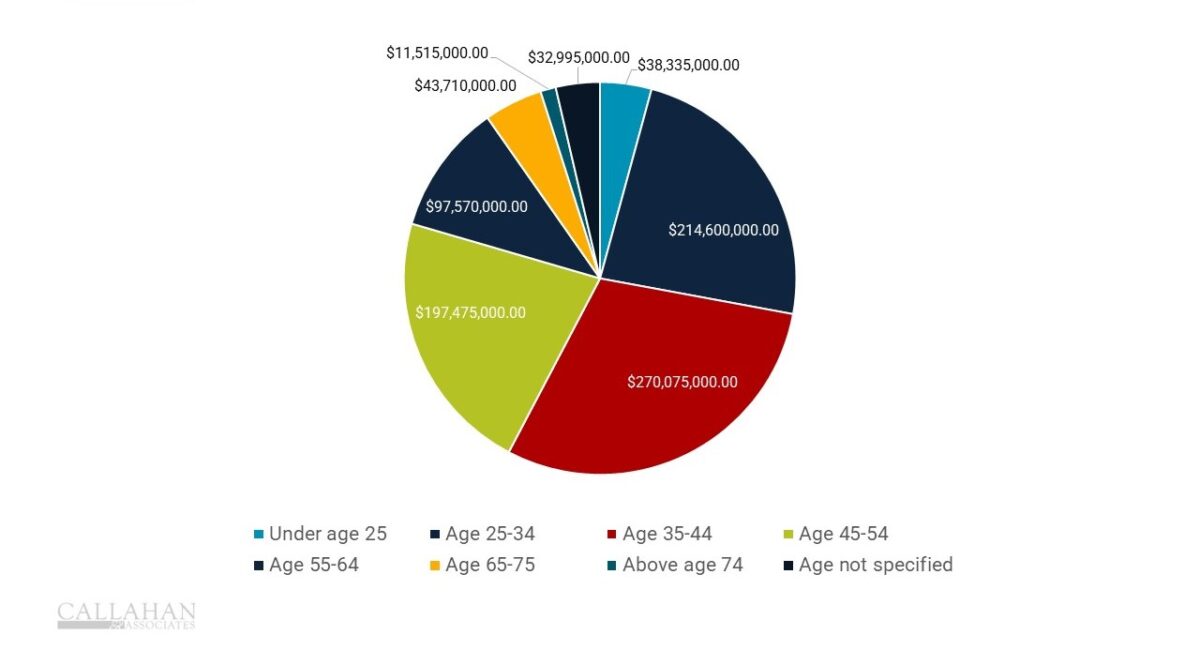

2023 MORTGAGE BALANCES BY AGE BRACKET

FOR LIBERTY FCU

© Callahan & Associates | CreditUnions.com

Does your membership skew younger? How is your credit union getting such a big slice of younger consumers?

Jeff White: Our overall membership does skew younger. At 46, our average member age is below that of the average U.S. credit union. We attribute some of this to our products and services on the retail side. Free high-interest and rewards checking, reimbursement of ATM fees from competing institutions, and a robust — and constantly improving — suite of mobile banking services. So, for us, it starts with members’ day-to-day banking needs.

Are there specific marketing tactics that have helped attract younger borrowers?

JW: Social media and other select media are a part of our strategy, but we primarily attribute our success in attracting younger buyers to our people. We invest heavily in having mortgage loan officers outside the branch in each of the communities we serve. They’re active, working with realtors, of course, but also in local chambers and networking groups, non-profits, coaching youth sports. Our loan officers are our most significant marketing channel by far.

How does this borrower composition compare to pre-COVID levels or a more normal housing market?

JW: We are seeing originations with younger members skewing a little higher than pre-COVID levels. Cumulatively, our average member age at closing, Q1 and Q2 2024 compared to the same time period in 2019, is down more than one full year to just over 40 years old.

Have you done anything different from a product standpoint to address the needs of younger borrowers?

JW: We’ve made the conscious effort to offer mortgage programs, not necessarily for younger borrowers, but for all borrowers. Through the years, we would find so many times that the standard mortgage options were great in ideal situations, but we were missing out on so many opportunities for other borrowers. In the past decade or so, our mortgage team has done a fantastic job of expanding our product lineup to meet the needs of more borrowers. This does largely benefit a younger audience as many of these newer options often offer a lower down payment.

Any advice for other credit unions looking to attract younger or first-time homebuyers?

JW: Attracting younger homebuyers is an organizational commitment. It takes having the people, the products, and even the delivery channels. Internally, ask questions such as: Will they meet the program criteria? Can the borrower easily apply on their phone?

If you put in the work, the demand is there.

Digital Investments To Meet Members Where They Are

Kara VanWert, chief lending officer for Veridian Credit Union, attributes her credit union’s success to building relationships, offering education, and making homeownership more attainable via a digital application.

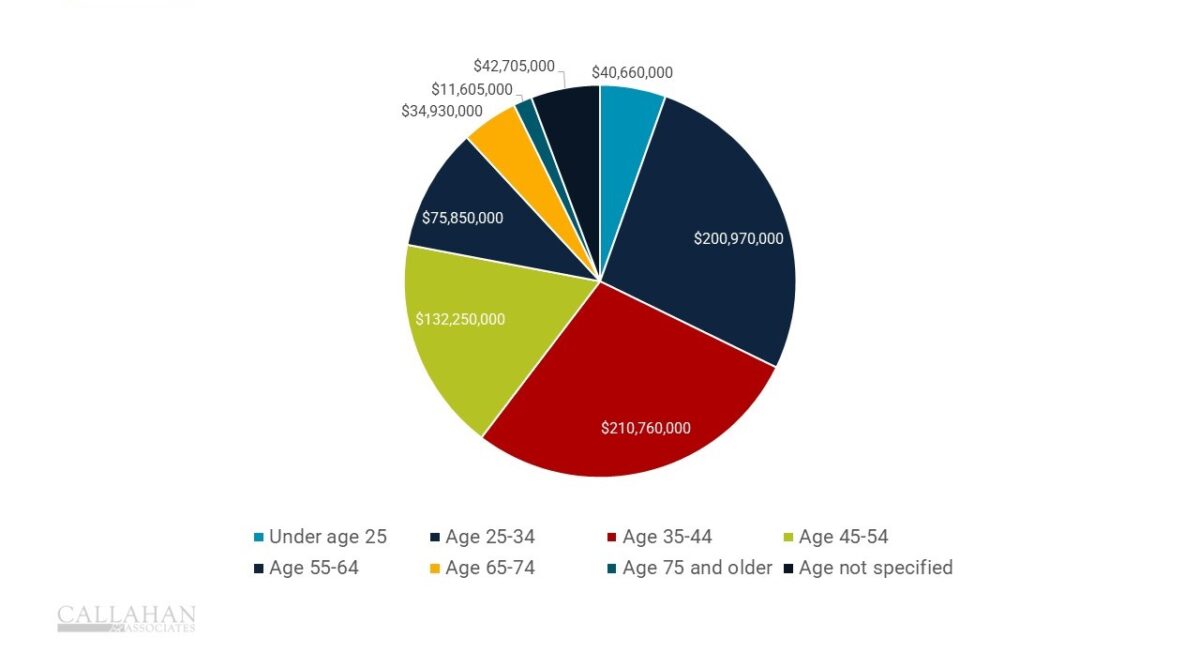

2023 MORTGAGE BALANCES BY AGE BRACKET

FOR VERIDIAN CREDIT UNION

© Callahan & Associates | CreditUnions.com

Does your membership skew younger? How is your credit union getting such a big slice of younger consumers?

KV: The average age of a Veridian member is 43.7 years old, which is younger than the average credit union member nationwide. We have a strong focus on offering our products and services digitally and meeting our members where they are.

Are there specific marketing tactics that have helped attract younger borrowers?

KV: We offer first-time homebuyer seminars and a series of videos focused on homebuying on our website and YouTube channel. But we’ve always had a focus on building relationships with real estate agents and partnering with them to offer financing options that make homeownership more attainable and affordable. We’re currently in a buyers’ market, and those relationships are more important than ever.

How does this borrower composition compare to pre-COVID levels or a more normal housing market?

KV: In 2019, 26% of our closed loans were to borrowers younger than 34. Today that age group represents 46% of our closed loans. While established homeowners are enjoying the record-low interest rates from refinancing in recent years, we’re in a buyers’ market. Many homebuyers today are purchasing their first home or upsizing for their growing families.

Have you done anything different from a product standpoint to address the needs of younger borrowers?

KV: Veridian’s mission is to partner with our members to create successful financial futures. We partner with several organizations working toward a similar purpose. For example, we partner with Iowa Finance Authority (IFA), who offers a FirstHome program that only requires 3% down. That, paired with our option for 100% financing, can help make home ownership more attainable and affordable.

Any advice for other credit unions looking to attract younger or first-time homebuyers?

KV: Offer technology throughout your loan application process that allows the borrower to complete as much of the transaction as possible online and be there to educate your borrowers along the way.

Partner with real estate agents to bring the homebuying experience full circle.

Homebuying is often overwhelming and perceived as unobtainable. Educate your members online and through seminars to show them how they can make their dream of homeownership come true.

— Interviews have been edited and condensed.

How Old Are The Borrowers In Your Credit Union’s Mortgage Portfolio?

Take a data-driven look at the age breakdown of your mortgage borrowers to see where you stack up against your peers. Backed by data from HMDA, the 5300 Call Report, and the U.S. Census Bureau, Peer offers endless opportunities to pull custom research to make strategic, member-driven decisions for your institution.

Request Mortgage Lending Scorecard