Macro Overiew And Industry Trends (4Q19)

Despite a slow first quarter, the industry reported strong growth across core financials in the past 12 months. What else should credit unions know at fourth quarter?

Despite a slow first quarter, the industry reported strong growth across core financials in the past 12 months. What else should credit unions know at fourth quarter?

Five can’t-miss data points this week on CreditUnions.com.

The decade ends with the three most productive lending quarters in the history of the credit union movement. Plus, more can’t-miss insights from Callahan’s quarterly webinar.

After a period of rebuilding, Coastal Federal Credit Union posts three record-breaking years.

Welcome to the 2020s. Based on January traffic (and our editorial instincts), here are the top articles and blogs that appeared on CreditUnions.com.

A decade-long, side-by-side snapshot reveals how the credit union landscape has changed from the tail end of the Great Recession to today.

Third quarter lending performance rebounds from a slow first half of the year.

The CEO of the Self-Help credit unions uses secondary capital to fight predatory lending and protect financially vulnerable consumers.

The loan-to-share ratio falls, and other can’t-miss insights from Callahan’s quarterly webinar.

This Veterans Day, see how military credit unions stack up to the industry as a whole.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

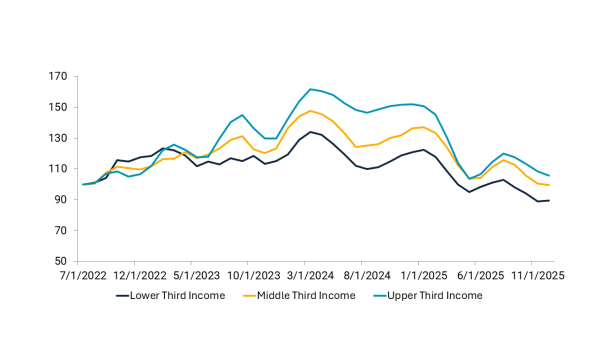

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

A veteran branch manager takes indirect lending to a new level at Erie FCU.

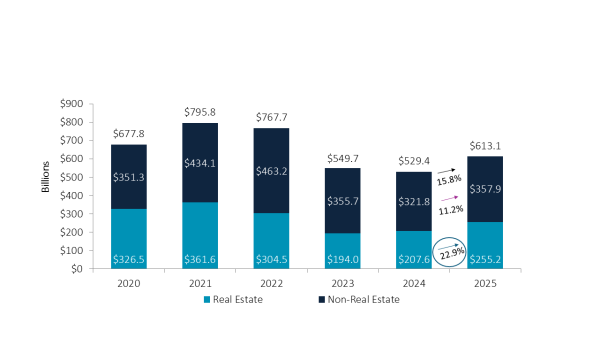

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.