5 Takeaways From Trendwatch 1Q 2023

A preview of the economic and performance trends that shaped the credit union industry during the first quarter, and how that could impact the months to come.

A preview of the economic and performance trends that shaped the credit union industry during the first quarter, and how that could impact the months to come.

From improving cross-sell opportunities to increasing efficiency, and beyond, here’s why credit unions should rethink their origination systems.

The Ohio cooperative has been working with vendors and testing new solutions to find the right fit for the new reporting standards.

In this day and age, credit unions must implement innovative technologies flexible enough to keep up with evolving member preferences. There are many avenues a credit union can take to provide the best tools to members, including hiring specialized talent for building proprietary software or outsourcing technology from financial technology companies. Choosing one option over

Dive into the performance trends that shaped the final quarter of the year, and learn how those metrics could impact the months ahead.

Borrowers look to credit unions for the best rates on conventional loans but use competitors for alternative low-payment financing options that incorporate residual values.

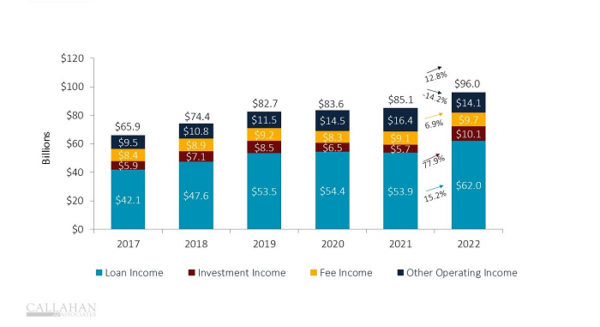

Outstanding loan balances grew 19.1% in the third quarter of 2022. That number has never been higher at U.S. credit unions. What else happened in the loan portfolio?

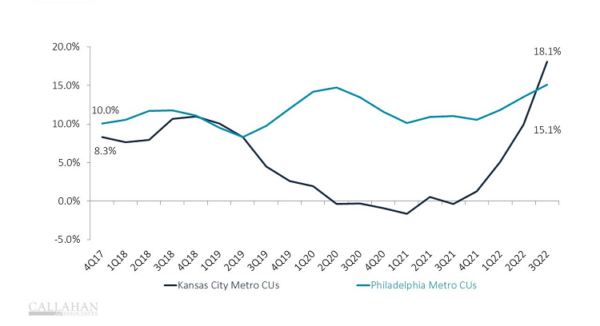

A look at the lending performance of credit unions in Kansas City and Philadelphia offers a novel way to forecast the winner of this year’s big game.

Changing member expectations call for new conveniences, and new technological solutions will help credit unions further their future success.

Vendors break down the problems they solve and highlight what makes them stand out in a crowded industry.

A preview of the economic and performance trends that shaped the credit union industry during the first quarter, and how that could impact the months to come.

From improving cross-sell opportunities to increasing efficiency, and beyond, here’s why credit unions should rethink their origination systems.

The Ohio cooperative has been working with vendors and testing new solutions to find the right fit for the new reporting standards.

In this day and age, credit unions must implement innovative technologies flexible enough to keep up with evolving member preferences. There are many avenues a credit union can take to provide the best tools to members, including hiring specialized talent for building proprietary software or outsourcing technology from financial technology companies. Choosing one option over

Dive into the performance trends that shaped the final quarter of the year, and learn how those metrics could impact the months ahead.

Borrowers look to credit unions for the best rates on conventional loans but use competitors for alternative low-payment financing options that incorporate residual values.

Outstanding loan balances grew 19.1% in the third quarter of 2022. That number has never been higher at U.S. credit unions. What else happened in the loan portfolio?

A look at the lending performance of credit unions in Kansas City and Philadelphia offers a novel way to forecast the winner of this year’s big game.

Changing member expectations call for new conveniences, and new technological solutions will help credit unions further their future success.

Vendors break down the problems they solve and highlight what makes them stand out in a crowded industry.