CECL: A Half-Baked Cake

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

Our Risk page is the top spot to learn about business continuity, compliance, enterprise risk management, fraud, and vendor management.

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

For the past decade, the credit union’s head risk leader has been evangelizing the idea that everyone must be a risk manager to ensure the

The crisis is still unfolding, but the latest high-profile bank failure has plenty of takeaways for credit unions around asset management, net worth, communication, and

The Quick Loan from Digital FCU offers a lifeline when members have more month than paycheck.

Consumer protections apply equally to in-house and outsourced collections teams, and training for compliance should be a priority.

Leaders at the Florida credit union offer expert advice on how to elicit more from tech vendors and engage members in product testing.

Nusenda Credit Union’s funds availability formula boosts member service by exceeding regulated minimums and treating outliers as outside the norm.

Numerica Credit Union has served cannabis businesses for five years. Learn how the shop monitors risk for these growing businesses.

The new CECL accounting standards are expected to raise reserves and concern alike, but there could be some upsides, too.

Delivering safe and frictionless member experiences requires up-to-date identity data and an authentication approach that quickly authenticates the caller before the member hears “hello.” The result is greater call center efficiency, decreased Average Handle Time, improved security, and higher member satisfaction.

Callers are identified and cleared or cornered before ever getting to a live human agent.

Five can’t-miss data points this week on CreditUnions.com.

Accurate, current data with real-time alerts is key to addressing fraud risk through today’s deposit channels.

When money stops making sense, people suffer a crisis of financial confidence. Now’s the time to reconnect with members to help them establish long-term stability.

From the teller line to the corner office, CEO Cheryl Sio’s story spans five decades of industry transformation and enduring leadership lessons.

Structured protection strategies provide potentially higher long-term total returns than bonds while muting the volatility and downside risk traditionally associated with equities.

The CEO of Peninsula Community Federal Credit Union highlights how active listening and lessons from the basket court shape a culture of inclusive banking that serves members and employees.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

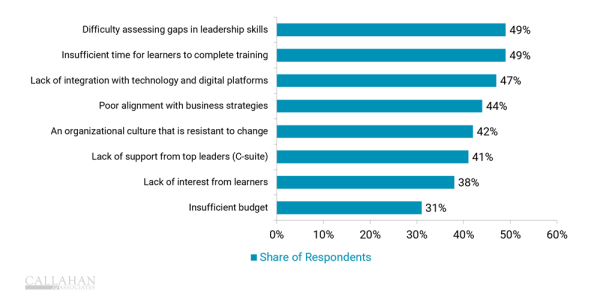

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

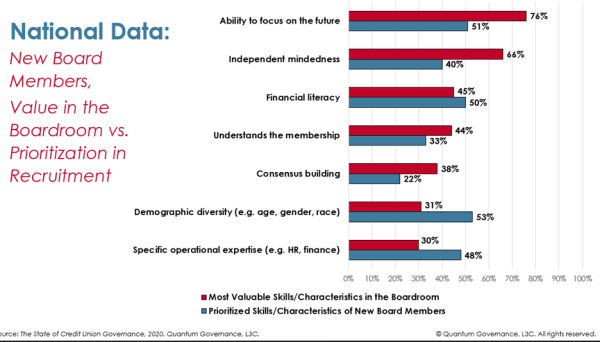

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.