Leaders In Efficiency At Year-End 2016

Check out this leader table to see which credit unions beat the industry average.

Check out this leader table to see which credit unions beat the industry average.

Feedback from Callahan’s annual Executive Outlook Survey highlights industry goals for 2017.

Callahan data shows there is a growing reliance on NII in keeping credit unions surviving and thriving.

A new approach to the credit union basics of people and finance helped this West Virginia cooperative turn six-figure losses into seven-figure gains.

The strong lending growth posted by U.S. credit unions in fourth quarter 2016 is an apt wrap-up for a successful year.

After Bitterroot Community FCU in Montana opened a new branch, it posted a 21.2% increase in new members.

Four can’t-miss data points featured this week on CreditUnions.com.

The national average for each of these six mighty metrics is less than 10 percentage points, but even a change of a few basis points can make a big difference to a credit union.

The Indiana credit union increased GAP sales by nearly 50% by thinking outside the vehicle protection box.

University Credit Union in Orono, ME, creates new positions and titles to streamline its lending environment.

Craft breweries demonstrate how commitment to value, operational agility, and community focus can ignite growth and drive property.

Discover how First Alliance Credit Union is redefining success by putting values and member needs at the heart of everything it does.

Explore the subtle shifts redefining the credit union core processing space and how these movements shape growth, innovation, and member experience.

The combination of the right philosophy and the right technology can set credit unions up for success even during difficult economic times.

Nearly 100 credit unions are providing Buy Now, Pay Later to their members, and their banking cores are giving them a surprising competitive advantage.

A perspective from Garrhett Petrea, vice president of sales and a Zillennial, on why outdated cores threaten the next generation of members and what leaders must do now.

Driving digital delivery? Evaluating vendor platforms? Sharpening tech strategy for a new year? This week of insights is built for credit union leaders looking to stay ahead.

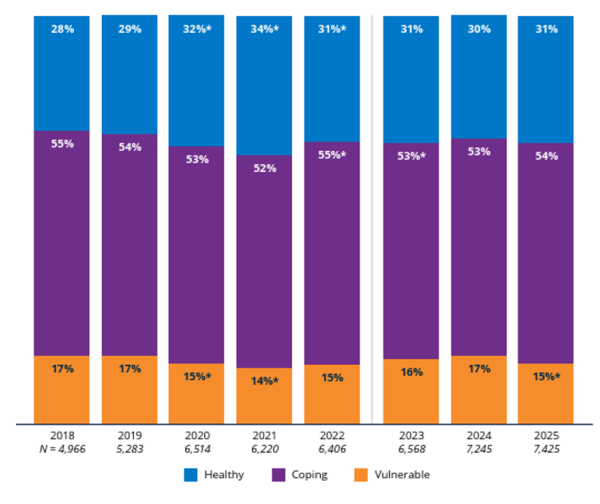

Having weathered a difficult five years, U.S households have modestly improved their financial situation in the short term; their long-term prognosis is murkier.

Third quarter performance data is a reminder that credit unions perform best when conditions are hardest.

From cross-cooperative collaboration to well-timed relief products and services, credit unions are lightening the holiday budget burden.