3 Takeaways From Trendwatch 2Q 2020

With second quarter data now available, COVID-19’s impact on industrywide metrics is more apparent. Discover how credit union balance sheets are shifting and other key insights from Callahan’s quarterly webinar.

With second quarter data now available, COVID-19’s impact on industrywide metrics is more apparent. Discover how credit union balance sheets are shifting and other key insights from Callahan’s quarterly webinar.

A locked-down economy combined with volatile changes in monetary policy put lenders in a difficult position in the first quarter of 2020, as total revenue growth slowed as sources of income shifted away from interest-driven streams.

This Fourth of July, Callahan & Associates is celebrating patriotically named credit unions with a look at how they return value to their member-owners.

General uncertainty regarding the interest rate environment made it difficult for institutions to accurately price deposit and loan products, which is reflected in year-end income statements.

Credit unions report improved earnings following 2018 rate cuts. However, increased expenses put downward pressure on margins.

Earnings growth extended into the second quarter as cooperatives reported higher net interest income than operating expenses for the second consecutive period.

A monthly collection of Callahan content that, together, addresses a single topic from a variety of perspectives.

Credit unions reaped the benefits of upward rate movement and the associated repricing benefits for new loan originations in 2018.

Largely a result of rising loan demand and interest rate trends, the amount of income generated at credit unions expanded throughout 2018.

As interest rates tick up, the margin between interest income and interest expenses at U.S. credit unions slowly expands. Test your knowledge of the state of the net interest margin in the fourth quarter.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

Discover how First Alliance Credit Union is redefining success by putting values and member needs at the heart of everything it does.

Craft breweries demonstrate how commitment to value, operational agility, and community focus can ignite growth and drive property.

Inflation, debt, and income inequality are fueling a K-shaped, post-pandemic recovery, widening the gap between different economic segments and challenging lower-income households.

Quarterly performance reports from Callahan & Associates highlight important metrics from across the credit union industry. Comparing top-level performance and digging into the financial statement has never been easier.

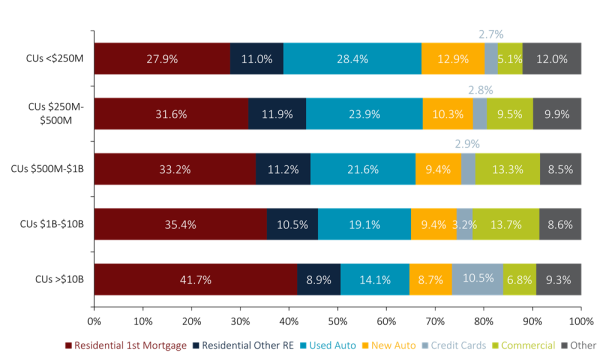

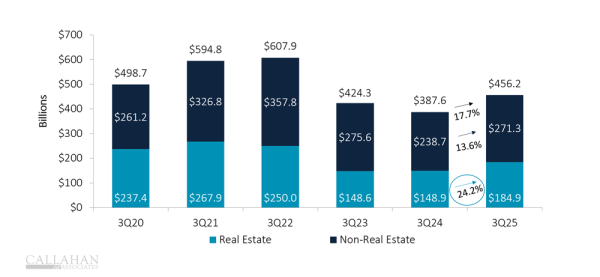

Explore how credit union size influences growth, lending, and efficiency.

Accelerating membership growth signals the increasing influence of credit unions amid evolving interest rate trends and economic challenges.

Falling interest rates are changing the game for credit unions. Explore how potential shifts in lending, savings, and margins are set to affect the bottom line.

Explore the subtle shifts redefining the credit union core processing space and how these movements shape growth, innovation, and member experience.

The combination of the right philosophy and the right technology can set credit unions up for success even during difficult economic times.