For many prospective members, a car dealership — not a branch — is their first interaction with a credit union.

At Erie Federal Credit Union ($805.9M, Erie, PA), that interaction now represents a meaningful touchpoint. In 2024 alone, the cooperative originated 3,415 auto loans through local dealers. With indirect lending growing in volume and influence, Erie elevated dealer engagement to a stand-alone role in May 2025 and named Lindsey Shatto as the organization’s first director of dealer engagement.

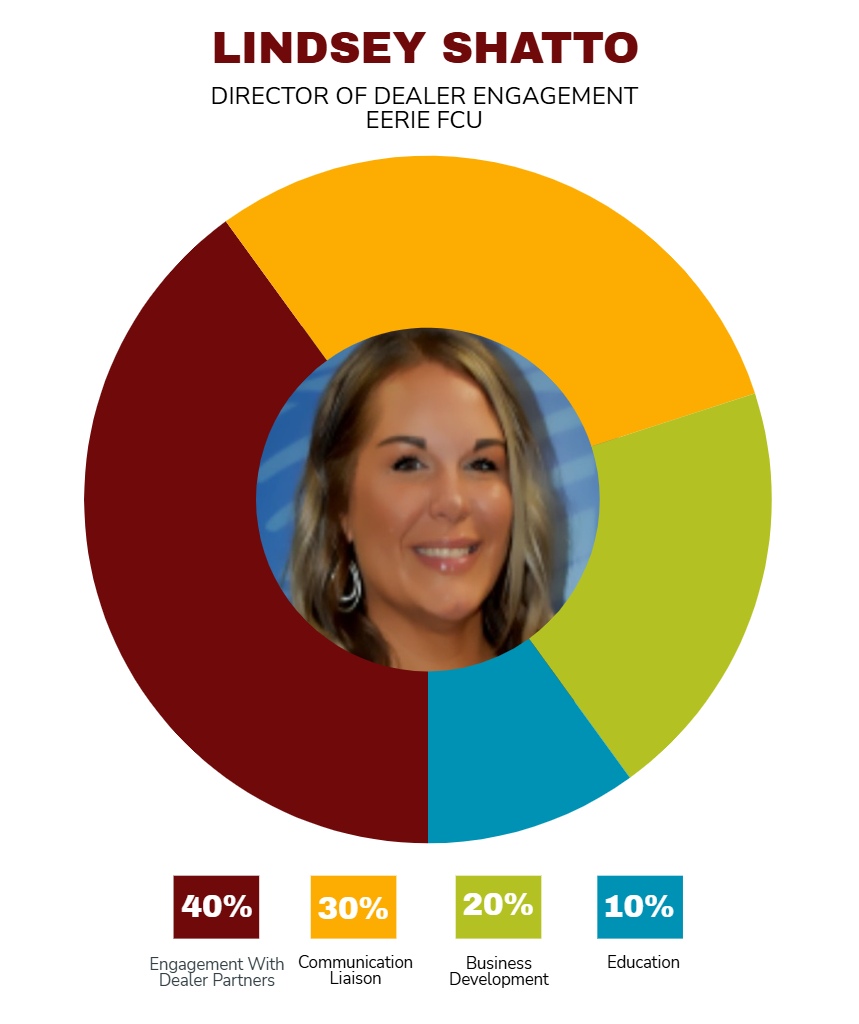

Here, Shatto discusses how the position extends beyond sales, and why her branch-based career prepared her to manage relationships that increasingly shape loan growth, brand perception, and the member experience before a member ever walks into a branch.

What is your elevator pitch when someone asks what you do?

Lindsey Shatto: The title “director of dealer engagement” reflects exactly what this role was created to do — engage. I work with dealerships to strengthen relationships, streamline processes, and make it easier for them to do business with us. My focus is on helping dealers finance more vehicles with less friction through fast, reliable lending decisions, proactive communication, and programs that support their relationship with Erie FCU.

What’s the story behind your title?

LS: In 2003, only captives and banks in our local market were offering indirect lending programs. Credit unions simply weren’t part of that arena. Erie FCU saw an opportunity to redefine what dealer relationships could look like and became the first credit union in the region to build an indirect lending program.

In the early years, dealer engagement was a part‑time responsibility carried by the indirect lending manager on top of managing underwriting, processes, and overall program development. But as our indirect program grew, it became clear that meaningful engagement required more than occasional dealer visits or transactional communication. This new role exists because Erie FCU recognized our dealers deserved a dedicated advocate, someone who could build relationships, solve problems, and elevate the entire partnership experience.

What makes your role interesting?

LS: No two days are ever the same. Each day gives me the opportunity to blend strategic planning, relationship‑building, education, and business development into every dealer visit I make. I’m constantly adapting — one moment I’m helping a dealer troubleshoot a challenge, the next I’m discussing program enhancements, analyzing market trends, or identifying new growth opportunities. The variety keeps the role dynamic, and the impact I can make with each interaction keeps it meaningful.

What facets of your job most energize you?

LS: Listening to what dealers are experiencing day-to-day and then turning that feedback into real solutions that make their partnership with us better. Seeing dealers and the credit union win — whether that’s faster funding, smoother communication, or increased financing — gives me energy and purpose.

Conversely, what part challenges you the most?

LS: One of the biggest challenges in my role is that each dealer relationship is different, and their needs, priorities, and expectations can shift quickly based on market conditions, inventory, and sales cycles. That means I’m constantly adapting my approach to support the dealer effectively while staying aligned with the credit union’s goals and capacity.

These challenges are also what make the role rewarding — they push me to stay sharp, stay engaged, and continuously refine how we support our dealer partners.

Any misconceptions about your role?

LS: Yes, one of the biggest is that it’s purely sales‑focused. Although sales is a component, it’s far from the whole picture. The true value of this role comes from developing relationships, providing ongoing education, ensuring strategic alignment, and supporting mutual growth between the credit union and our dealer partners.

My responsibility isn’t just to bring in business — it’s to build trust, strengthen partnerships, understand dealer needs, and ensure they feel supported at every step. It is helping them navigate our processes and being a resource they can rely on.

What is the No. 1 skill you need to do your job?

LS: Relationship‑building. Everything else — communication, confidence, resilience, time management, organization — supports that core ability. To be effective, you must genuinely enjoy learning about people, understanding their communication styles, and adapting to the way they do business.

When you build strong relationships, you earn credibility, open doors for collaboration, and create the kind of mutual trust that leads to long‑term success for both the dealer and the credit union.

Who do you report to and who reports to you?

LS: I report to Stephanie Warnshuis, Erie FCU’s indirect lending manager. My role is an individual contributor, but I collaborate closely with the indirect lending team.

CU QUICK FACTS

ERIE FCU

HQ: Erie, PA

ASSETS: $805.9M

MEMBERS: 80,294

BRANCHES: 11

EMPLOYEES: 221

NET WORTH: 9.9%

ROA: 0.24%

You moved directly from branch operations into this role. How did the branch experience prepare you?

LS: The transition represented a shift in scope and audience, but the heart of the work remains the same. In branch management, my focus was on leading teams, supporting members, and ensuring smooth branch operations. In dealer engagement, the focus expands outward. I focus on building relationships with dealerships, understanding their business needs, and representing the credit union in a much broader, market‑driven capacity.

During 17 years in branch operations, I built deep, meaningful relationships with our members and truly learned about their lives, families, and financial needs. That level of personal connection sharpened my interpersonal skills, empathy, and communication — qualities that are essential when representing the credit union to our dealership partners. Branch management also taught me how to stay organized, handle fast‑paced environments, and adapt quickly — skills that translate directly into managing dealer expectations and navigating the fast-moving world of indirect lending.

How does your role contribute to the success of the credit union in ways people might not expect?

LS: Long before a member ever walks into a branch, their first interaction with Erie FCU might happen inside a dealership finance office. My role directly influences that first impression.

I ensure dealerships understand our financing, present it accurately, and feel confident offering Erie FCU as a trusted option. When dealers are well‑supported, educated, and engaged, they’re more likely to promote our products, highlight our benefits, and position us competitively in the financing conversation. That directly impacts our approval volumes, membership growth, and overall loan portfolio performance.

Beyond that, my role is a bridge between the credit union and the marketplace. I gather real‑time insights from dealers, identify trends, and bring back opportunities or challenges that help us improve our processes, enhance our programs, and stay ahead of the competition. Those insights shape strategy in ways that many internal teams may never see firsthand.

This role becomes essential when indirect lending becomes a meaningful driver of growth and when dealership interactions begin to influence the credit union’s brand reputation. At that point, dealer engagement can no longer be a secondary responsibility — it must become a strategic priority.

If your role didn’t exist, what would your credit union be missing?

LS: If my role didn’t exist, Erie FCU would be missing a key component of what truly sets us apart in our market — the ability to intentionally and consistently engage with our dealership partners in a way that supports our mission: “to responsibly deliver financial solutions that serve the needs of our community.”

Indirect lending is often a member’s first encounter with Erie FCU. Without this role guiding those relationships, we risk losing visibility, competitiveness, loan business, and the personal connection that sets us apart from other financial institutions.

In short, we would lose a vital link between our credit union, our dealers, and the community we serve.

Why and when does a credit union need this role?

LS: This role becomes essential when indirect lending becomes a meaningful driver of growth and when dealership interactions begin to influence the credit union’s brand reputation. At that point, dealer engagement can no longer be a secondary responsibility — it must become a strategic priority. Without it, opportunities are missed, relationships weaken, communication gaps form, and the credit union risks losing competitive ground.

What other roles do you see driving credit unions forward in a modern financial services environment?

LS: Several emerging roles are becoming essential for credit unions as they navigate a rapidly changing financial services landscape. These jobs combine human connection with technology, data, and community impact — areas where credit unions naturally excel. These roles ensure credit unions remain member‑focused while leveraging modern tools to stay competitive and relevant.

This interview has been edited and condensed.