First South Financial Credit Union ($523.8M, Bartlett, TN) has used targeted, analytics-driven marketing to post impressive metrics including industry-topping credit card growth.

To help drive those results, the Memphis credit union often uses a local vendor’s turnkey service for high-value product campaigns such as home equity loans and credit cards.

The credit union chooses a focus and then leverages its own resources using tools from its marketing partner. Those tools can include anything from simply a list for emails or direct mails to the whole campaign from start to finish.

First South uses emails like this to encourage members to adopt electronic services. Click here to view larger size.

We vary it by campaign, says Delynn Byars, the credit union’s senior vice president of marketing. Sometimes we create the email or direct mail piece. We’ve also done campaigns, like our non-member checking campaign, where [the vendor] handles it from start to finish and we tweak the message and the imagery.

First South also uses the firm to enhance member data and help Byars focus marketing dollars on products or people. In a loan campaign, for example, the credit union might use the firm to target existing members who have the greatest capacity and propensity to take out a certain kind of loan, Byars says. Or, the firm might suggest a campaign or target segment and First South will develop its own list and creative or give the lead list to the branches.

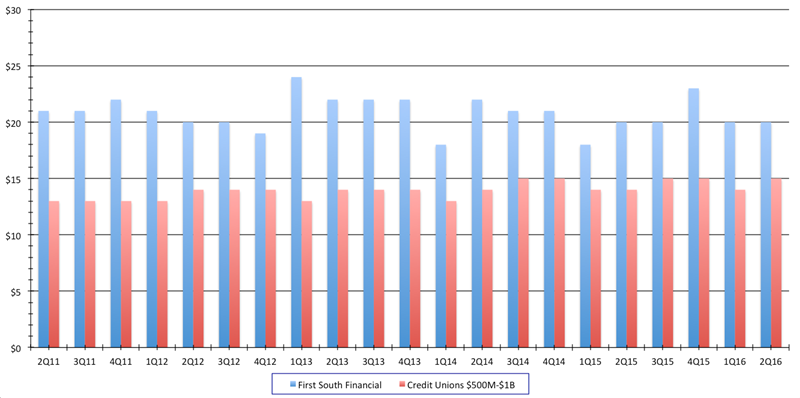

First South spends notably more on marketing per member than most credit unions its size: $20 per member in second quarter 2016, compared with $15 for its $500 million to $1 billion peer group

MARKETING EXPENSE PER MEMBER

FOR U.S. CREDIT UNIONS $500M-$1B IN ASSETS | DATA AS OF 06.30.16

Source: Peer-to-Peer Analytics by Callahan & Associates.

But that’s because it gets results, Byars says. First South has reaped more than 2,000 responses to the offers it has made to more than 15,000 new members since spring 2011 and has improved retention, electronic services engagement, and accounts per household.

And in a recent credit card campaign, First South targeted 4,436 member households, resulting in 62 new credit card accounts and $229,146 in new outstanding balances during the tracking period. It was the most successful cross-sell campaign to date.

How Do You Compare?

Check out First South Financial’s performance profile on Search & Analyze. Then build custom peer groups and access reports for more meaningful comparisons.

Search & Analyze

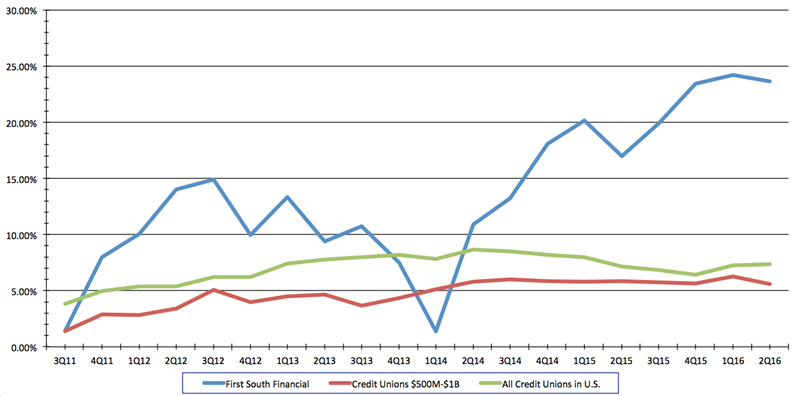

Campaigns like this have helped First South out-perform both its peer group and industry in credit card growth the past several years. In second quarter 2016, it posted year-over-year growth of 23.65%, according to data from Callahan & Associates. That’s in the top 10% for credit unions with $500 million to $1 billion in assets and in the top 5% for all credit unions nationwide.

CREDIT CARD GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.16

Source: Peer-to-Peer Analytics by Callahan & Associates.

CU QUICK FACTS

First South Financial Credit Union

Data as of 09.30.16

HQ: Bartlett, TN

ASSETS: $523.8M

MEMBERS: 57,057

BRANCHES:14

12-MO SHARE GROWTH: 4.7%

12-MO LOAN GROWTH: 16.0%

ROA: 1.89%

First South’s payment options include monthly fees, flat fees, and pay-for-performance. For example, it pays $100 for a new HELOC that closes. Nothing if it doesn’t. The credit union’s pay-for-performance new member acquisition campaigns have attracted 655 new members to First South since 2011. These members in turn have opened 1,179 new accounts.

According to Byars, each of the credit union’s acquisition campaigns now nets approximately 100 new members, and she says if each of those members is worth $400 a year, then the credit union yields an ROI of 390%.

First South Financial Credit Union uses Infusion Marketing Group for its data-driven marketing campaigns. Find your next solution in the Callahan & Associates online Buyer’s Guide.

Onboarding newly acquired members is another priority for the marketing team. Members receive six messages, one per month for six months, based on factors such as credit scores and the products and services they use.

Byars says First South Financial uses a 180-day cycle because the typical 90- to 120-day onboarding process is not long enough to make an impression amid the messaging consumers are exposed to on a daily basis.

Six months is not unreasonable for onboarding campaigns today, Byars says. It takes more repetition to resonate with our target market.