DIRECT DELINQUENCY VS INDIRECT DELINQUENCY

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.23

© Callahan & Associates | CreditUnions.com

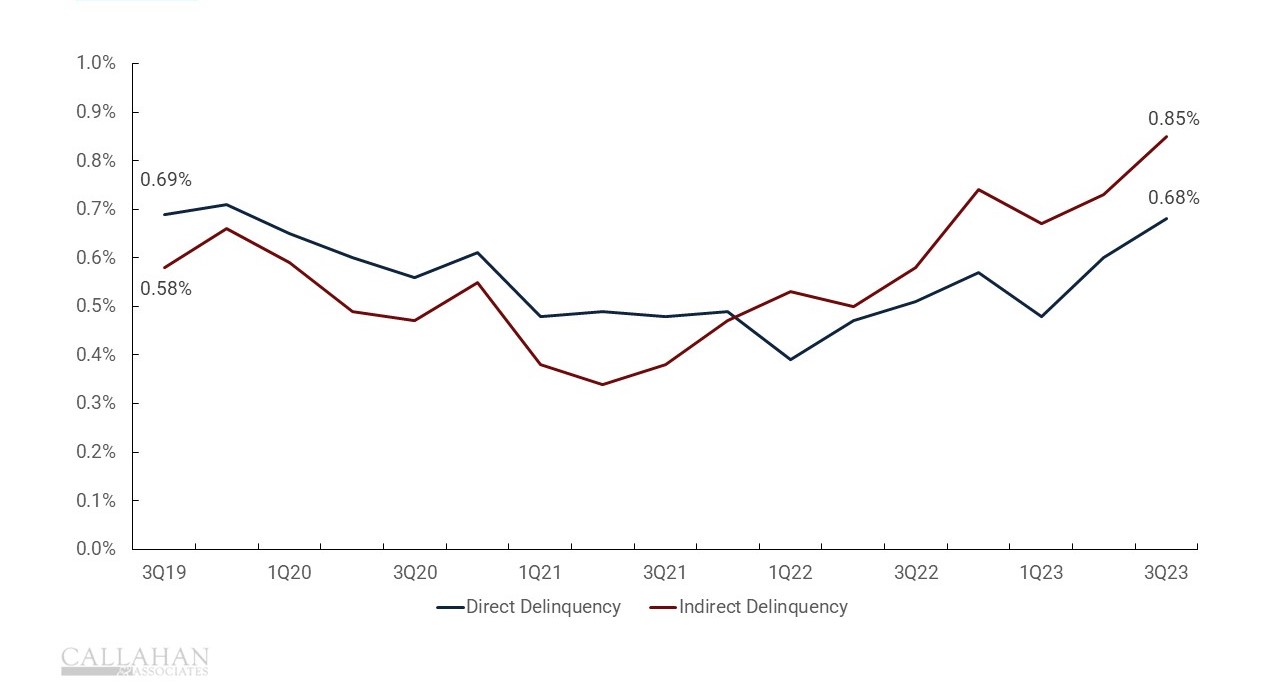

- Delinquency on indirect loans has been higher than for direct loans in recent quarters, which is a reversal of earlier trends. In the third quarter of 2023, indirect delinquency reached 0.85%, 17 basis points higher than direct. Credit unions use indirect lending to source loans through third-party channels; however, this rise in delinquency shows the strategy is not without risk.

- Indirect lending at credit unions, which mostly comprises auto lending, increased 35.1% in 2022 and 9.6% in 2023 as credit unions used the channel to make up for plummeting loan originations and foot traffic during the COVID-19 pandemic. As of the third quarter of 2023, indirect loans made up an all-time high of 22.2% of the loan portfolio.

- Delinquency for both indirect and direct lending at credit unions rose 61 basis points year-over-year. This general deterioration in asset quality is important to watch as interest rates remain elevated. Credit unions currently have set aside $1.66 for every $1.00 of delinquent loans, which is down from $2.16 in March of 2023 but still a healthy cushion.

The Ultimate Performance Packet For Finance Leaders

Whether you have key metrics of your own or looking for some guidance from Callahan’s credit union experts, we’ll show you how how easy it is to streamline your reporting and communicate findings with leaders.

Request Your Free Finance Scorecard

Request Your Free Finance Scorecard