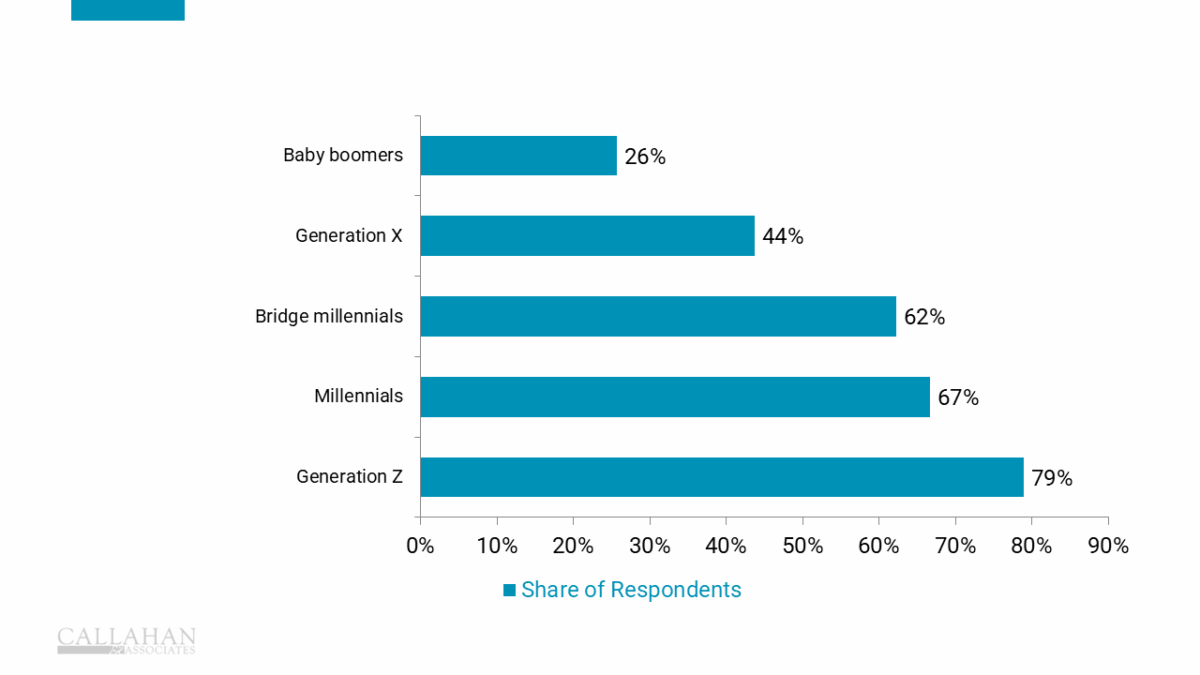

Digital Wallet Usage By Generation

For U.S. Consumers (Sample size: 2,501 respondents)

SOURCE: PYMNTS INTELLIGENCE | Data as of February 2024

There’s a stark divide in digital wallet adoption, with Gen Z embracing those tools more than any other age bracket – and at more than three times the rate of baby boomers. Put another way, those born before 1980 use digital wallets at a rate almost 20 percentage points below those born in 1980 or later.

Digital wallets can be defined as apps designed to allow spenders to use their cards to transact entirely on their phone. Some of the most popular – including Apple Pay, Venmo, or Google Wallet – are becoming increasingly common consumer-facing financial technology.

Strategic Insights

- While digital wallet usage vary by generation, there’s more uniformity when it comes to income. According to a recent study by PYMNTS Intelligence, just over half (54.7%) of Americans making over $100,000 use a digital wallet. By comparison, 51.4% of those making $50,000 to $100,000 use these tools, and 41.2% of those who make less than $50,000. In the entire sample, 49.4% of Americans use a digital wallet, while 51% of U.S. consumers said they are somewhat or very interested in using a digital wallet.

- For credit unions, the speed of adoption is certainly something to take note of, especially as the industry works to expand its reach. Younger Americans tend to prefer more digital options, and a recent study from Velera showed the number of credit union members using digital wallets at least a few times per month has nearly doubled, rising from 27% in 2022 to 50% in 2024.

- Successfully navigating fintech adoption can give credit unions an edge. Through partnerships, credit unions can go head first in expanding member-facing technologies without having the expertise in-house to do so.