How 2 Marketing Teams Organize For Impact

The organizational structures for the marketing teams at 3Rivers FCU and Leaders Credit Union couldn’t be more different, but they share a common goal.

The best place to learn about credit unions strategies like branding, PR, social media, and engagement to attract members!

The organizational structures for the marketing teams at 3Rivers FCU and Leaders Credit Union couldn’t be more different, but they share a common goal.

Practical tips from marketing pros for navigating brand integration, from aligning messaging and honoring legacy to building trust and more.

The Member Story Project from Callahan & Associates invites credit unions to share their stories of member impact and celebrate how they change lives every

Four ways credit unions can harness their data to show up in their members’ lives at the right time — and in the right way.

An array of experiences and professional development opportunities, combined with drive and passion, has positioned James Hunter for success in the field of DEI.

Watch this webinar to find new solutions that can help you better understand your members.

A partnership between the credit union and a community nonprofit provides financial resources for at-risk kids during formative years.

A collaboration between Freedom First FCU and a local nonprofit is helping consumers ensure they can afford to buy a home and stay there for the long haul.

A look at how CDFI credit unions stack up in performance as well as geography.

How the staff at a Twin Cities credit union works together to find, record, and share compelling tales of making a difference.

The average share balance per credit union member dropped more than $200 across 2023 as high inflation weakened savings.

Lessons from five credit unions on using member impact stories to inspire staff and boards, educate members, and add some pizzazz to social media accounts.

Members’ stories aren’t just proof credit unions fill a vital need for consumers — they’re also an opportunity for innovation.

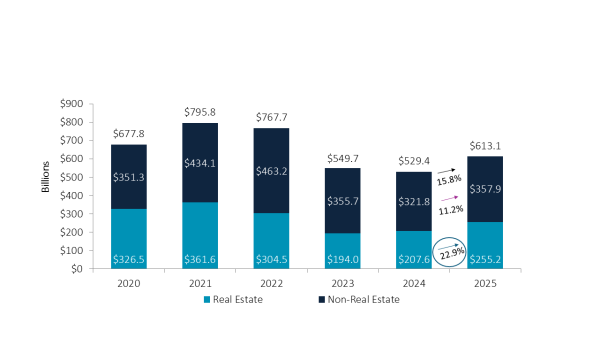

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.

This year’s finalists are reimagining how credit unions can use AI to combine cutting-edge technology with old-school member service.

Financial advice comes in many forms. How can credits union make sure they are the No. 1 choice for their members?

This year’s finalists are uncovering new ways to harness the power of technology to improve and expand lending across the industry.

A program to help staffers improve their savings skills generated more than $200,000 in deposits and helped change participants’ financial habits.

When Members Talk, Listen