After two years of rapid interest rate hikes from the Federal Reserve and a voracious hunt for deposits, credit unions might finally be able to breathe a sigh of relief.

Credit unions could benefit from reduced funding costs and new repricing opportunities. Those will most likely impact borrowings, loans, and investments, and many institutions will be looking to regain balance sheet flexibility as these shifts continue.

The New Normal — Now What?

Liquidity needs drove many balance sheet decisions in recent years, including lending and deposit strategies, investment portfolio management, and capital generation.

After rapid rate increases in 2022 and 2023, credit unions have adjusted to the new normal just in time for a rate cut cycle. Many shops are preparing for this shift by maximizing balance sheet flexibility.

- Borrowings now fund 5.2% of industry assets, down from a peak of 6.0% at the start of 2024, as managers started to pay down these costly funding sources. Loan and share growth continue to move at the same slow pace, lessening the need to lean on borrowings to meet loan demand.

- During the past 12 months, credit unions attracted $61 billion in shares — primarily through certificate promotions — while loan balances increased just $42 billion. This is a stark contrast from 2022 and much of 2023, when loans on the balance sheet often outpaced incoming shares by more than $100 billion over any given 12-month

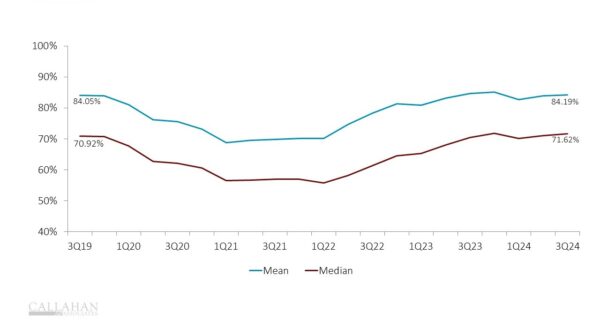

After a dramatic two-year increase, the loan-to-share ratio has flattened, hitting 84.2% at the end of the third quarter. Even with the worst of the liquidity crunch behind them, many credit unions are sitting on the sidelines, reducing certificate promotions, paying down borrowings, and slowing their lending. The goal is to wait for rate cuts, which should bring cheaper funding opportunities.

Your Performance Packet Is Ready. It’s Time To Take Your Credit Union To The Next Level. Sit down with a Callahan advisor to review your tailored performance packet, and we’ll show you how your credit union measures up against peers in cost of funds, investment and loan yields, loans to shares, and more. Armed with this knowledge, your leadership team can make better plans and set stronger goals. What are you waiting for? Request your session today.

LOAN-TO-SHARE RATIO

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Rates And Repricing Opportunities

With inflation seemingly under control, the Fed has shifted its goals toward economic stimulation. Core inflation hit 3.2% in August, a number the Fed seems to be more comfortable with. Along with that, the Fed has cut its benchmark rate by 75 basis points since September.

However, economic data released after the Fed’s November meeting generated mixed reactions. Stronger-than-expected retail sales in October led some Fed officials to suggest the economy still has some cooling off to do and advised that the Fed should pause further rate cuts until inflation nears the traditional 2% target.

Once more rate cuts come, credit unions will have an opportunity to reprice some deposits and borrowings at lower rates.

- More than 80% of current share certificate balances are set to mature by the end of September 2025. That represents 23.4% of total shares. Credit unions will likely wish to keep these funds around after the certificates mature, ideally at a lower cost. Members could reinvest in another certificate, move the funds into another account, or into a brokerage account to invest in the stock market.

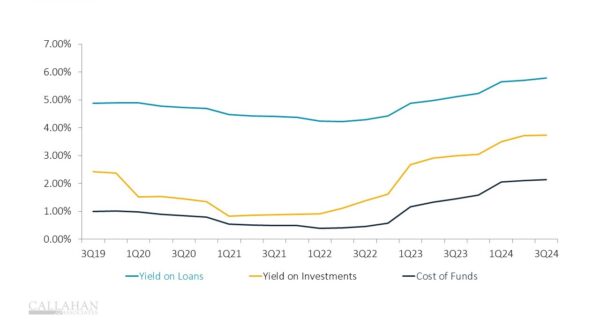

- Keeping funds in-house could provide some relief. Credit unions’ cost of funds increased 67 bps year-over-year to 2.13% in the third quarter of 2024.

YIELD ANALYSIS (ANNUALIZED)

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Borrowings represent a less-prominent repricing opportunity.

- 3% of current borrowings are set to mature by September 2025.

- The average cost of borrowings settled at 5.17% in the third quarter. That gives the 1,064 U.S. credit unions that borrow real opportunity to reduce costs if interest rates fall.

More Borrowing Ahead?

Borrowing can be a cost-effective option should members move their funds elsewhere as certificates mature. Although the prevailing rate environment does impact deposit prices, cash availability and competition play a significant role. Borrowings, on the other hand, should be available at cheaper costs following rate cuts and can be used if member shares remain hard to come by. Borrowed money only comprises 5.2% of industry assets today but could grow as rates decline.

Lower benchmark rates won’t only be felt in funding costs, but in loans and investments too.

- 8% of real estate loan dollars outstanding are set to contractually reprice, mature, or refinance in the next five years — up from 26.4% one year ago. However, some of these maturing and repricing loans are pandemic-era loans originated at even lower interest rates than today’s environment, so even with rate cuts coming, we could see some repricing to the upside.

- 7% of the industry’s investment securities will mature in the next 12 months, offering little time to reinvest these funds into higher investment yields before rates move lower.

- Similar to loans, many of these maturing investments were purchased when yields were ultra-low during 2020 and 2021, so most credit unions hope to move these assets off the books as soon as possible. For credit unions with spare liquidity to invest today, locking in termed securities pre-rate cuts could provide an added boost to the earnings in the years to come, and could even generate some portfolio gains — a welcome concept after the past few years of handcuffing unrealized losses.

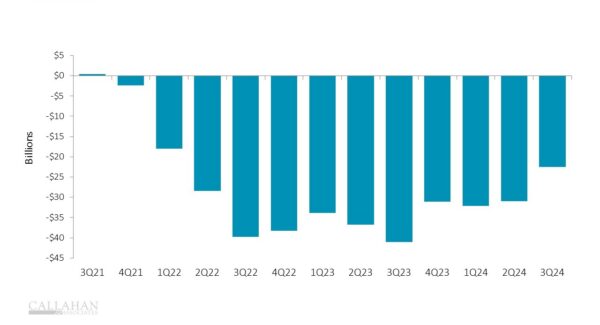

Recent rate cuts reduced the industry’s total unrealized loss on available-for-sale securities by $8.4 billion in the third quarter. That boosted capital and provided some relief for portfolio managers locked into these losing securities for the past few years. These securities haven’t yet reached their break-even price, but the smaller the unrealized loss, the easier it is to sell the security. That will free up liquidity to lend to members or reinvest at today’s higher rates.

ACCUMULATED UNREALIZED GAIN (LOSS) ON AVAILABLE-FOR-SALE SECURITIES

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Ultimately, rate cuts should give credit unions something they haven’t had for the past couple years — flexibility. Just over 25% of combined termed shares and borrowings will mature in the next year, and credit unions will look to reduce the interest rates paid on existing deposits should rate cuts materialize. This will lower the cost of funds, which has more than quadrupled during the past two years. Funds from maturing investments will either be reinvested at lower yields or loaned to the community should demand rebound. Credit unions have learned from the past and are positioned to adapt their balance sheets to whatever comes in 2025.

Higher interest rates have forced members to pick and choose which debts to repay and which to postpone, which doesn’t are well for revolving products. Read more in “Asset Quality Is Worsening. Is There Light On The Horizon?”