Where Are The Gaps In Financial Inclusion?

Marginalized communities are largely unbanked or underserved, but credit unions can bolster inclusivity and enhance the financial wellbeing of these groups.

Marginalized communities are largely unbanked or underserved, but credit unions can bolster inclusivity and enhance the financial wellbeing of these groups.

There are different motivations for delving into green lending, but five in particular apply to the strategic focus of credit unions.

More than half of Americans younger than 50 say they would consider purchasing an electric vehicle. That’s an opportunity for credit unions.

Positive views of small business transcend political party, age, and gender.

Look beyond the headlines to discover the driving forces behind market trends and consider how they impact a credit union’s investment portfolio.

In 2023, 38% of financial institutions reported fraud loss between $500,000 and $1,000,000. What does this mean for credit unions?

A report from the MIT Technology Review indicates artificial intelligence usage across multiple business sectors is poised to explode by the end of 2025.

Constructive action and positive impact are the product of a board engaged in servant leadership — the true calling of a Class A board.

Credit unions are turning toward the Federal Reserve’s Bank Term Funding Program to mitigate liquidity pressure.

Gallup data shows employers aren’t engaging workers nearly as deeply as they would like.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

When money stops making sense, people suffer a crisis of financial confidence. Now’s the time to reconnect with members to help them establish long-term stability.

From the teller line to the corner office, CEO Cheryl Sio’s story spans five decades of industry transformation and enduring leadership lessons.

Structured protection strategies provide potentially higher long-term total returns than bonds while muting the volatility and downside risk traditionally associated with equities.

The CEO of Peninsula Community Federal Credit Union highlights how active listening and lessons from the basket court shape a culture of inclusive banking that serves members and employees.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

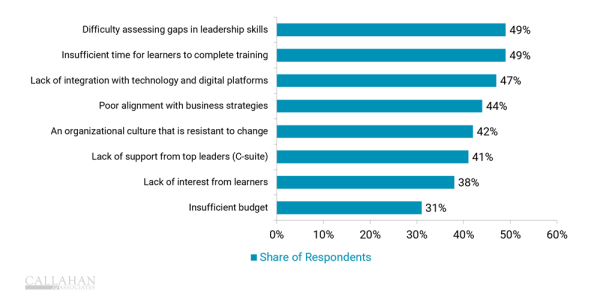

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

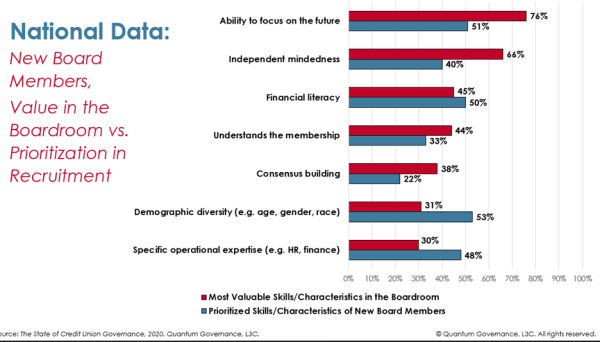

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Green Lending: What Is Your ‘Why?’