Better Deposit Strategies Elevate Member Experience

With deposits per branch up 50% in the past five years, many credit unions are redeploying staff to provide more holistic offerings such as financial counseling.

With deposits per branch up 50% in the past five years, many credit unions are redeploying staff to provide more holistic offerings such as financial counseling.

The Virginia cooperative bucks the CD trend with a high-rate savings product aimed at members who need help building budgetary resiliency.

A partnership with United Ways of Iowa is uncovering insights about employed community members who struggle under limited assets and constrained income.

A new partnership gives the Texas-based credit union a broader reach for name, image, and licensing deals, providing access to some 600 university athletes.

The cooperative boosts its standing with Southern California’s Hispanic community as part of a bid to expand financial inclusion.

New stores of federal funding are now available to help credit unions cultivate a growing business in solar and more.

Rising electric vehicle usage has led some institutions to install electric vehicle charging stations at branches. The move could help both the planet and the bottom line.

There are different motivations for delving into green lending, but five in particular apply to the strategic focus of credit unions.

A program at Abound Credit Union has helped hundreds of would-be small business owners since its launch eight years ago.

Risks are evolving as rapidly as the technology. Here’s how some cooperative leaders are coping.

Blaze, Consumers, and Interra credit unions pioneer a new path to liquidity under the guidance of Alloya Corporate.

A one-day event to give back has transformed into an initiative that spans several states and generates hundreds of thousands of dollars in community impact.

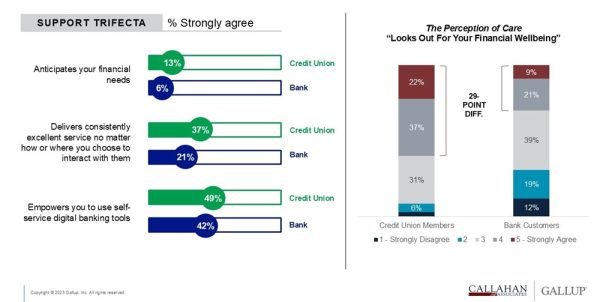

Are members thriving, struggling, or suffering? Just a few simple strategies can foster member financial wellbeing and boost the bottom line.

Lending, savings, community support, and more. Cooperatives unite to create lasting prosperity.

Bad actors don’t rest. Credit unions are beefing up cybersecurity with smarter tools, stronger teams, and sharper defenses.

Cyber threats never stop. Credit unions share how collaboration, AI, and smarter strategies protect members and institutions.

October is Cybersecurity Awareness Month, and CreditUnions.com has the lowdown on assessment tools, AI strategies, the role of collaboration in fighting fraud, and more.

A quartet of Northeastern Pennsylvania credit unions came together to share strategies and best practices for combatting check fraud, account takeover, and more.

From check fraud to suspicious logins, see how well you can sniff out red flags before they cost members money.

Credit unions can simplify compliance, reduce risk, and enhance member trust by rethinking loan servicing with outsourced solutions designed to keep pace with evolving regulations.

Green Lending: What Is Your ‘Why?’