High interest rates and asset prices hampered first quarter loan originations in the United States, according to Callahan & Associates’ analysis of first-quarter data from the National Credit Union Administration. Tightened underwriting standards by lenders navigating limited liquidity and weakening asset quality also contributed to the decline.

The Federal Reserve is projected to cut rates several times in 2024; however, even if it does, soaring prices and dwindling savings leave Americans with little incentive to make a big purchase.

YTD LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 3.31.2024

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

- Total loan originations for U.S. credit unions declined 15.6% year-over-year to the lowest first quarter total since 2019. Non-real estate loan originations declined 18.3%; real estate fell 9.9%.

- A HELOC boom cushioned the decline in real estate originations. That origination category — other residential real estate — increased 6.7% year-over-year. Members are using the equity derived from higher home values to make home improvements, consolidate debt, and fund major purchases.

- Commercial real estate originations fell 25.8% year-over-year, a milder decline than in the first quarter of 2023. Commercial originations comprised 14.7% of total real estate originations, down 3.1 percentage points from a year ago.

- Non-real estate originations declined 18.3% year-over-year, largely driven by credit unions tapping the breaks on indirect lending. The active origination years of the pandemic are over; fortunately, the rates of June 2024 rates offered stronger loan yield and revenue for lenders.

Are You Leaving Loans On The Table? Use industry data to dig into credit union performance, evaluate your market, uncover new areas of opportunity, and support strategic initiatives. Do you know how you compare to peers? Callahan’s credit union advisors are ready to show you. Request A Peer Suite Demo Today.

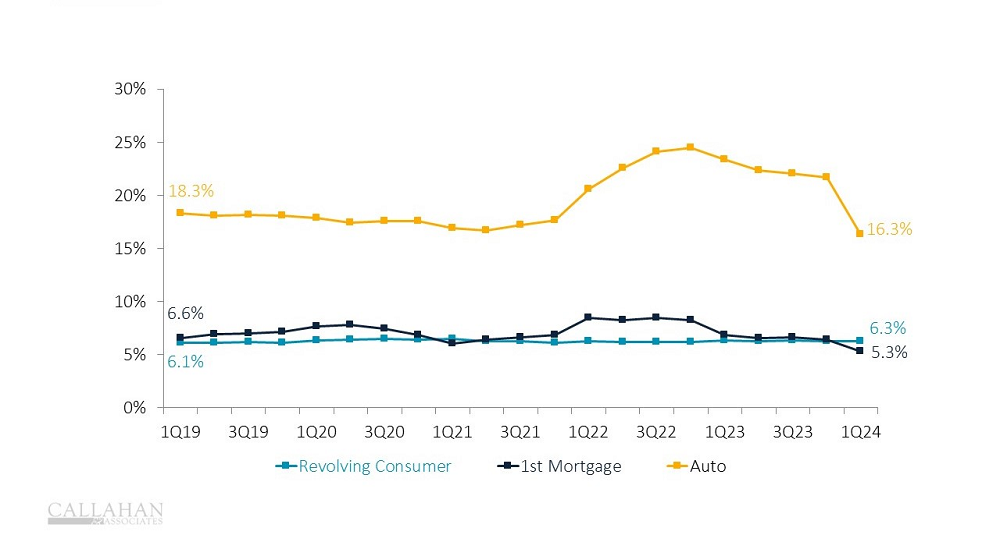

CREDIT UNION MARKET SHARE OF ORIGINATIONS BY PRODUCT

FOR U.S. CREDIT UNIONS | DATA AS OF 3.31.2024

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

- Credit unions surrendered market share in both auto and first mortgage in the first quarter of 2024; revolving consumer loan market share was unchanged. The fall in auto represents a return to the industry’s historical norm.

- Credit unions might be shying away from used autos in particular because of declining asset quality — used auto loan net charge-offs spiked to 1.03% in the first quarter of 2024. Autos sourced through indirect channels are also suffering from worsened asset quality, further exacerbating the credit union pull-away from indirect partnerships.

- Suppressed production of new cars in 2020 and 2021 has trickled down to create a low supply of used cars in today’s market. Meanwhile, the supply of new cars has recovered, but consumers are struggling to afford the higher borrowing costs. This dynamic is pushing dealers to offer better incentives for new cars, making them the most affordable — based on how many weeks of income it takes to purchase the average new vehicle — since July 2021, according to Cox Automotive.

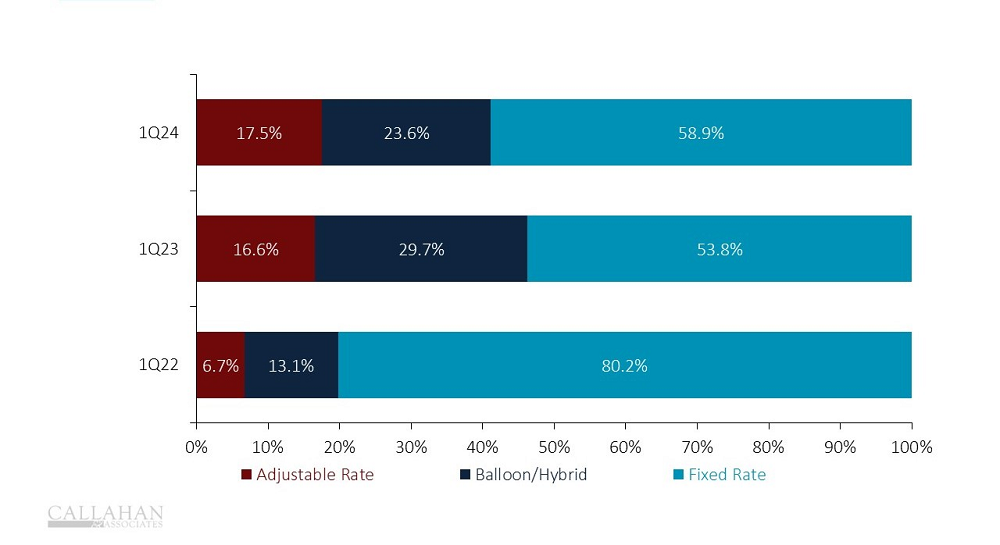

RESIDENTIAL FIRST MORTGAGE ORIGINATION COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 3.31.2024

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

- From December 2023 to June 2024, high rates and home prices have created a lethal combination of affordability in the mortgage market. Financial institutions would readily lock in 30-year mortgages at today’s high rates, but prospective homebuyers are less inclined. Those interested in homeownership are adopting a wait-and-see mentality, hoping affordability improves.

- Current trends in first mortgage originations show a strong borrower preference for adjustable rate and balloon/hybrid mortgages. Two years ago, when interest rates were only beginning to rise, fixed-rate mortgages comprised 80.2% of originations. Today, they comprise 58.9%, which is on par with the years prior to 2020. Higher rates have also dampened refinance activity, as the majority of mortgages are locked into low rates.