Have High Interest Rates Put A Dent In Housing Prices?

Surging interest rates historically have dampened homebuyer enthusiasm, but housing supply also is playing a role in today’s originations.

Surging interest rates historically have dampened homebuyer enthusiasm, but housing supply also is playing a role in today’s originations.

A pilot program aims to increase access to credit for people of color by bringing together multiple lenders to share data and practices as well as explore new underwriting practices.

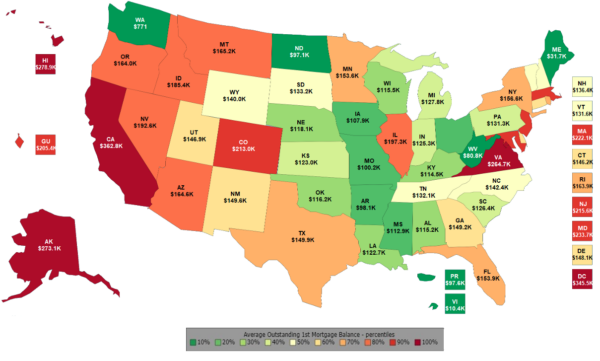

Home prices reached record highs last year. They have since come down slightly but are still well above pre-pandemic rates. Here’s how things look state by state.

The Grand Canyon State cooperative is offering three new products to reach underbanked members and provide financial education for adults and young members alike.

TAPCO Credit Union boosted loan volumes with a campaign that put a new spin on a not-safe-for-work expression.

Credit card delinquencies have reached a post-recession high; meanwhile, first mortgage delinquencies have hit an all-time low. What gives?

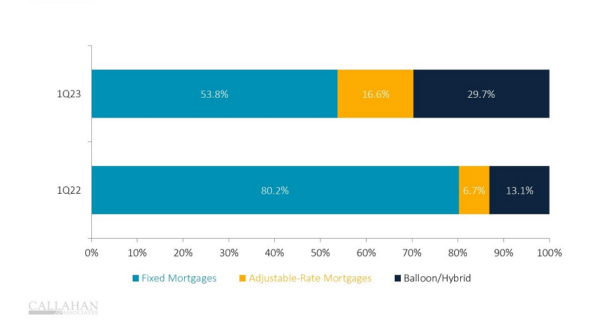

As the market shifts and borrowing costs rise, adjustable-rate home loans are becoming popular once again.

Housing is less affordable today than it was before the 2008 housing crisis. How did we get here? And how can credit unions help?

Watch this webinar to hear why investing in technology, in any economic environment, is priority number one is a number one priority for MemberOne Credit Union

New data underscores how far minorities have to go to catch up.

Surging interest rates historically have dampened homebuyer enthusiasm, but housing supply also is playing a role in today’s originations.

A pilot program aims to increase access to credit for people of color by bringing together multiple lenders to share data and practices as well as explore new underwriting practices.

Home prices reached record highs last year. They have since come down slightly but are still well above pre-pandemic rates. Here’s how things look state by state.

The Grand Canyon State cooperative is offering three new products to reach underbanked members and provide financial education for adults and young members alike.

TAPCO Credit Union boosted loan volumes with a campaign that put a new spin on a not-safe-for-work expression.

Credit card delinquencies have reached a post-recession high; meanwhile, first mortgage delinquencies have hit an all-time low. What gives?

As the market shifts and borrowing costs rise, adjustable-rate home loans are becoming popular once again.

Housing is less affordable today than it was before the 2008 housing crisis. How did we get here? And how can credit unions help?

Watch this webinar to hear why investing in technology, in any economic environment, is priority number one is a number one priority for MemberOne Credit Union

New data underscores how far minorities have to go to catch up.