Share Growth Changes Reflect Member Appetite For Higher Yields

Members are moving their shares from liquid deposits to certificates in an effort to earn more from their money.

Members are moving their shares from liquid deposits to certificates in an effort to earn more from their money.

Despite building savings during the pandemic, less than half of Americans feel comfortable with their level of emergency savings today. Even that comfort is not evenly distributed.

How the staff at a Twin Cities credit union works together to find, record, and share compelling tales of making a difference.

The average share balance per credit union member dropped more than $200 across 2023 as high inflation weakened savings.

Lessons from five credit unions on using member impact stories to inspire staff and boards, educate members, and add some pizzazz to social media accounts.

Members’ stories aren’t just proof credit unions fill a vital need for consumers — they’re also an opportunity for innovation.

Differences in how men and women view financial inclusion contribute to a drop in global ranking for the United States.

Steph Harrill Kyle helps UW Credit Union take a holistic approach to doing business by the cooperative principles.

An inclusive approach to home loans at Honor Credit Union helps the cooperative confront inequality across Michigan.

Callahan is helping leaders make the most of their time with stories meant to inspire creative, different thinking.

Blaze, Consumers, and Interra credit unions pioneer a new path to liquidity under the guidance of Alloya Corporate.

A one-day event to give back has transformed into an initiative that spans several states and generates hundreds of thousands of dollars in community impact.

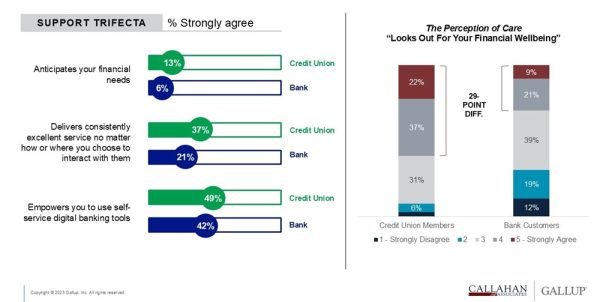

Are members thriving, struggling, or suffering? Just a few simple strategies can foster member financial wellbeing and boost the bottom line.

Lending, savings, community support, and more. Cooperatives unite to create lasting prosperity.

Bad actors don’t rest. Credit unions are beefing up cybersecurity with smarter tools, stronger teams, and sharper defenses.

Cyber threats never stop. Credit unions share how collaboration, AI, and smarter strategies protect members and institutions.

October is Cybersecurity Awareness Month, and CreditUnions.com has the lowdown on assessment tools, AI strategies, the role of collaboration in fighting fraud, and more.

A quartet of Northeastern Pennsylvania credit unions came together to share strategies and best practices for combatting check fraud, account takeover, and more.

From check fraud to suspicious logins, see how well you can sniff out red flags before they cost members money.

Credit unions can simplify compliance, reduce risk, and enhance member trust by rethinking loan servicing with outsourced solutions designed to keep pace with evolving regulations.

When Members Talk, Listen