2023 Vendor Showcase

Vendors break down the problems they solve and highlight what makes them stand out in a crowded industry.

Vendors break down the problems they solve and highlight what makes them stand out in a crowded industry.

Callahan & Associates surveyed 333 credit unions to learn about automated decisioning practices in the consumer lending portfolio. Read about the results in this interactive article.

Amid market volatility and ongoing loan demand, cash balances decreased nearly $66 billion. What else happened in the investment portfolio?

Strong loan growth combined with increased investment and fee income helped propel credit union net income during the first quarter.

The credit union balance sheet is shifting as the U.S. economy enters a post-pandemic reality.

Major revisions to the call report take effect in the first quarter of 2022. Here’s what you need to know.

Credit unions are positioning their balance sheets to deliver greater yields as investment and lending conditions adapt to a late-pandemic environment.

Looking for new solutions? Check out these featured credit union suppliers.

Looking for new solutions? Check out these featured credit union suppliers.

An impact benchmark is a worthwhile endeavor, but community impact doesn’t stop — or even start — with a number.

Craft breweries demonstrate how commitment to value, operational agility, and community focus can ignite growth and drive property.

Discover how First Alliance Credit Union is redefining success by putting values and member needs at the heart of everything it does.

Explore the subtle shifts redefining the credit union core processing space and how these movements shape growth, innovation, and member experience.

The combination of the right philosophy and the right technology can set credit unions up for success even during difficult economic times.

Nearly 100 credit unions are providing Buy Now, Pay Later to their members, and their banking cores are giving them a surprising competitive advantage.

A perspective from Garrhett Petrea, vice president of sales and a Zillennial, on why outdated cores threaten the next generation of members and what leaders must do now.

Driving digital delivery? Evaluating vendor platforms? Sharpening tech strategy for a new year? This week of insights is built for credit union leaders looking to stay ahead.

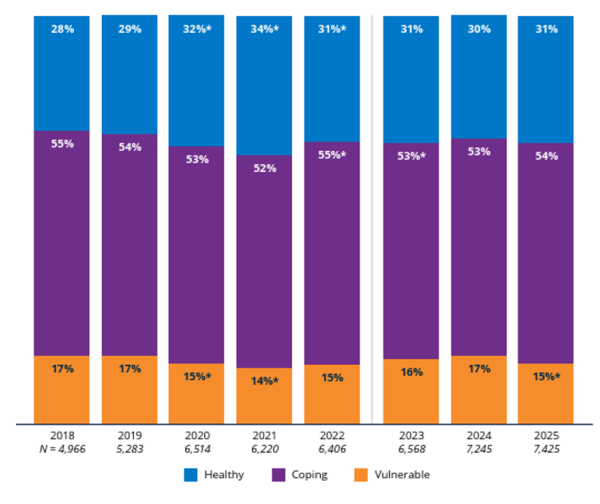

Having weathered a difficult five years, U.S households have modestly improved their financial situation in the short term; their long-term prognosis is murkier.

Third quarter performance data is a reminder that credit unions perform best when conditions are hardest.

From cross-cooperative collaboration to well-timed relief products and services, credit unions are lightening the holiday budget burden.

What Happened To Investments And Cash Balances In The First Quarter?